Good morning! Back again with another edition of the Product-Led Geek. Here’s what you’ll find inside:

📅 GEEKS OF THE WEEK: 5 links for you to bookmark

🧠 GEEK OUT: Revenue Mix Planning

😂 GEEK GIGGLE: 1 thing that made me laugh this week.

Total reading time: 6 minutes

Let’s go!

Painful, Slow Research was passionate about slowing down product development, hiding in fragmented tools, hoarding knowledge in silos, and causing unnecessary friction for teams.

They’re survived by Dovetail, the leading AI-powered customer insights hub that gives everyone on the product team instant access to customer insights, at any time.

RIP Painful, Slow Research. Long live shared customer understanding.

Dovetail. More than better research. It’s a new way to understand your customer. Want to learn more? Check out Dovetail’s latest AI features.

Please support our sponsors!

Enjoying this content? Subscribe to get every post direct to your inbox!

📅 GEEKS OF THE WEEK

5 bookmark-worthy links:

🧠 GEEK OUT

Designing future revenue mix to level-up your growth plan

I’m always surprised when I meet a founder who can roughly tell me what their revenue mix looks like today, but is unable - or hasn’t yet considered - what they think it should be in 12, 18, 24 or 36 months from now.

I’ve found that incorporating the detail of revenue mix shift into the planning cadence - and as an overall gauge on the business - to be a very effective way to increase alignment across the company around the things we need to change to achieve the overall business goals that we've set.

Of course, the right way to do it is to incorporate this as an integral part of how you set those overall business goals.

Different types of revenue mix

I like to apply two types of revenue mix shift in planning, but your business may benefit from others (for example if a significant portion of your revenue is services based and you aim to reduce that over time in favour of more efficient recurring software subscription revenue, then you’d want to include that perspective).

For B2B SaaS companies I find the below two perspectives most valuable:

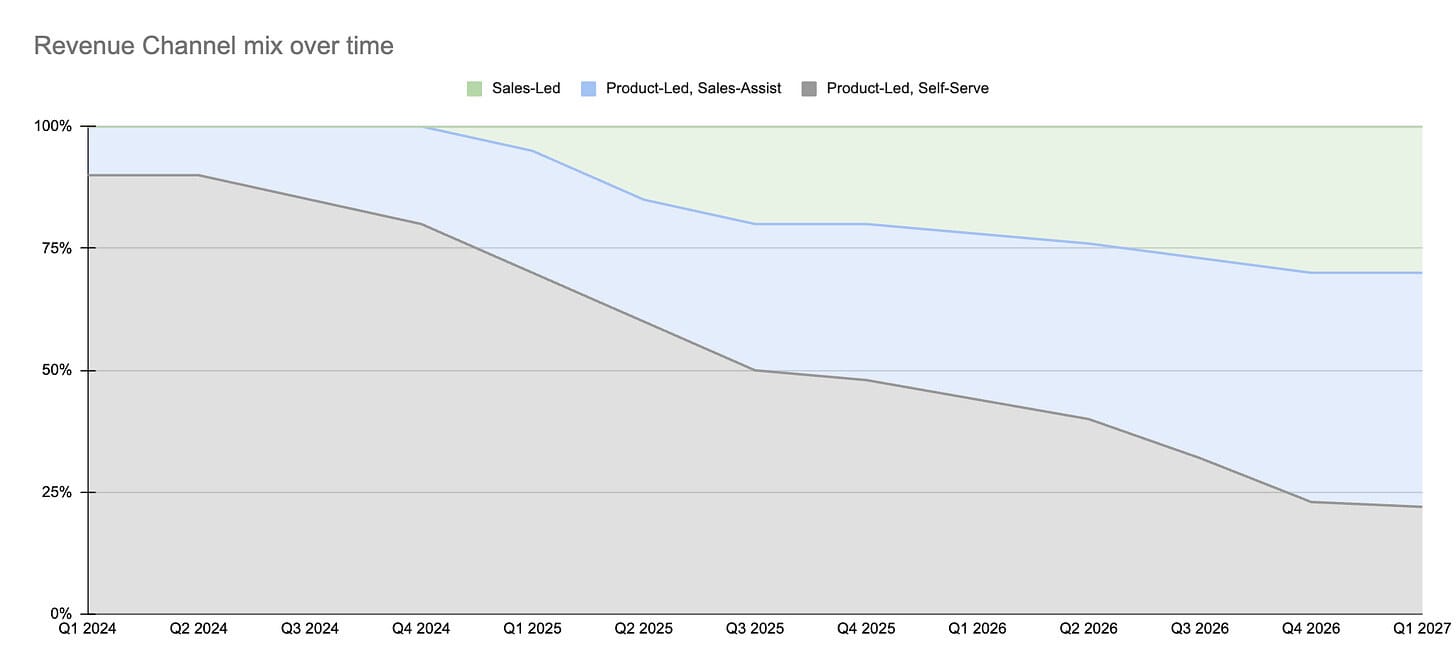

Sales motion

Product-Led, Self-serve

Product-Led, Sales-assist

Sales-Led

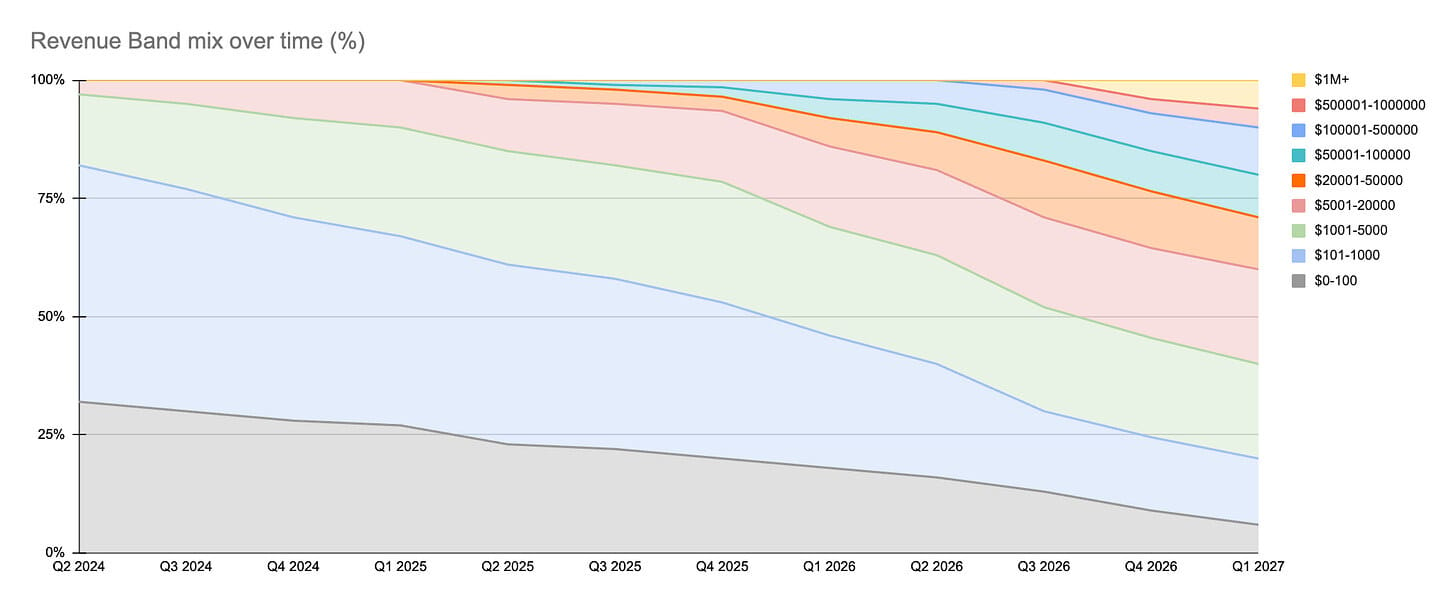

ARR band

$0-100

$101-1000

$1001-5000

$5001-20000

$20001-50000

$50001-100000

$100001-500000

$500001-1000000

$1M+

For ARR band, the values you use for each band should make sense for your business. So long as they are appropriate* for your business and market, the specific numbers are less important.

What matters is creating the bands and using them to track revenue over time and to plan how you want that to change.

Geek note: *When I say appropriate here, I mean relative to your market, different types of customers, and their willingness to pay, but also the cost to serve them.

A simplistic planned mix shift focuses on change over time to the sales motion, with an assumed ACV for each motion.

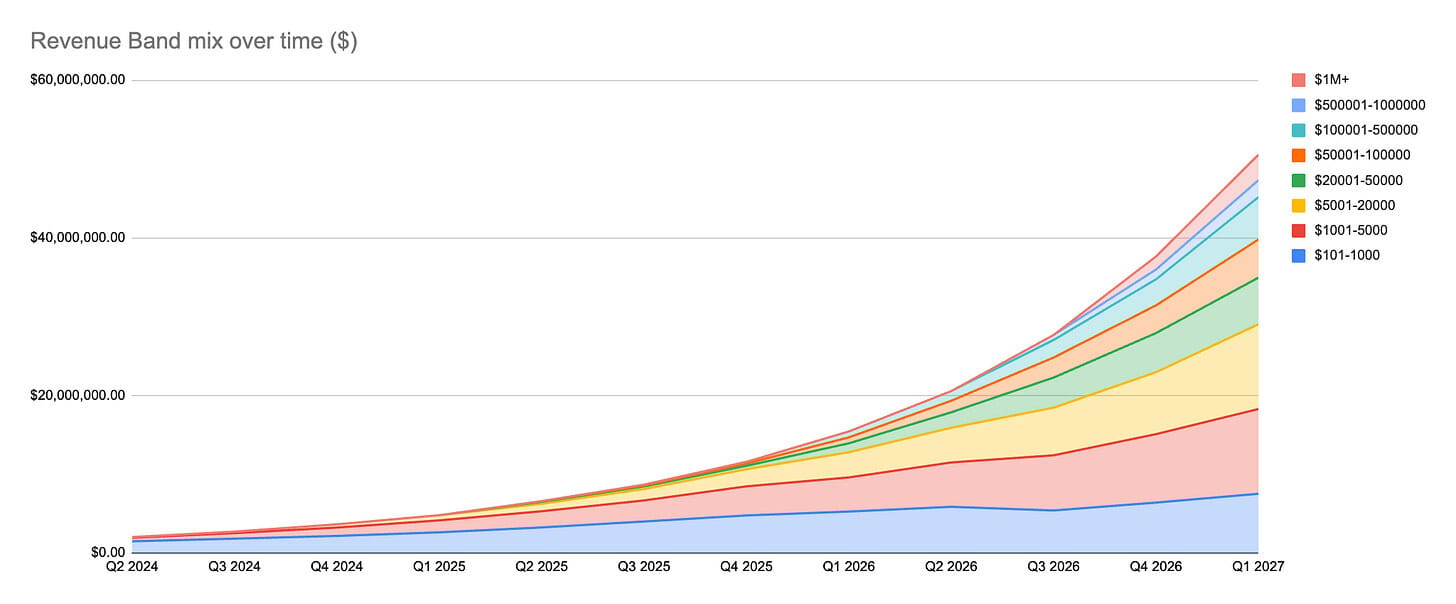

A more detailed model brings in revenue bands for a more granular perspective.

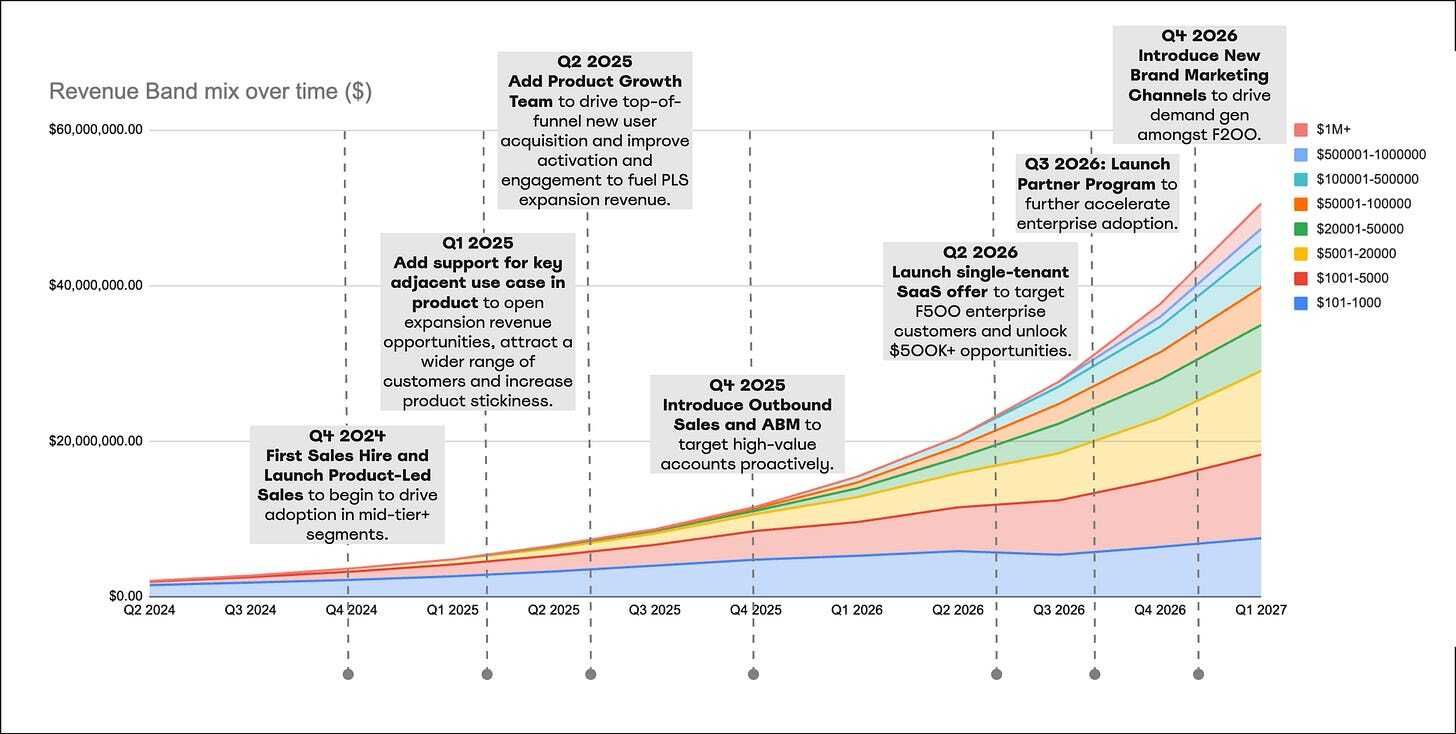

Here’s a simple example from a PLG-native company with an initial 100% reliance on low-ACV self-serve revenue, shifting over time to a hybrid go-to-market model, increasingly capturing larger opportunities with an enterprise sales motion.

You’ll need to look at percentages (for a macro perspective) as well as actuals as you more deeply explore and discuss the implications.

Implications of planned revenue mix shift

There are many potential implications of a planned revenue mix shift.

Need to support new use cases in product

Need to add enterprise specific governance capabilities

Need to evolve your ICP

Need to target different personas within your ICP

Need to introduce a self-serve motion

Need to introduce product-led sales

Need to introduce outbound sales and marketing

Need to change GTM hiring velocity

Need to adjust sales floor (typically via some of the other things in this list)

Need to introduce new marketing channels

Need to retire features and/or products

Need to invest in greater support efficiency

Need to drive more top-of-funnel new user acquisition

Need to increase month X account-level retention

Need to reduce ramp time for new reps

…

Considering that all these changes imply some varying degree of implementation lead time, as well as further ramp time to take effect, you can see the importance of having greater clarity in your target.

It’s important to note that you don’t do this in isolation, or even to lead your strategic planning, but rather to augment and support it.

It should provide an additional level of fidelity in your product and go-to-market planning.

Use it to more confidently answer questions like

HOW will we reach revenue growth of X within Y years?

and, given some assumptions on S&M spend across different ARR bands,

HOW would a given revenue plan impact margins?

It will never exactly go to plan of course, but this analysis and asking and answering the right questions will lead you to create better plans that the team can understand and rally behind.

If we look again at our scaling PLG company, our plan might look something like this:

Q4 2024: First Sales Hire and Launch Product-Led Sales to begin to drive adoption in mid-tier+ segments.

Q1 2025: Add support for key adjacent use case in product to open expansion revenue opportunities, attract a wider range of customers and increase product stickiness.

Q2 2025: Add Product Growth Team to drive top-of-funnel new user acquisition and improve activation and engagement to fuel PLS expansion revenue.

Q4 2025: Introduce Outbound Sales and ABM to target high-value accounts proactively.

Q2 2026: Launch single-tenant SaaS offer to target F500 enterprise customers and unlock $500K+ opportunities

Q3 2026: Launch Partner Program to further accelerate enterprise adoption.

Q4 2026: Introduce New Brand Marketing Channels to drive demand gen amongst F200.

It’s not set and forget

You need to monitor progress and consciously adjust your execution accordingly.

How are we tracking against our plan at any given point?

Is the plan still valid?

Have our assumptions changed?

Or more specifically ask questions like

Did the change in our ABM strategy lead to the revenue impact and mix shift that we expected?

Is our new self-serve motion driving the coverage we wanted it to at the lower end of the market?

Did our new product offer lead to the attach rates and ACV change that we planned?

You’ll also want to look back at historic mix shift.

Doing so will help you identify trends that you may need to act upon.

For example unexpected and unplanned relative increase in growth in a lower revenue band at the expense of a higher band could indicate issues such as

Incorrectly defined ICP

Poor positioning

Misaligned targeting

Sales skills gaps

Product gaps and deficiencies

…

So the data here can be a signal that alerts you to potential issues needing further diagnosis.

Summary

None of this is rocket science, and plans inevitably change, but whenever I’ve seen this done as part of a regular planning cadence it’s generated incredibly useful discussions that forced assumptions to be stated, tested and challenged, and ultimately led to better informed and aligned plans. The bottom-up input also helps to create goals that are better considered, with increased buy-in across the org.

Give it a try!

😂 GEEK GIGGLE

SHARE THE LOVE → PROFIT

The PLGeek Growth Process

Get the PLGeek Growth Process

Do you know someone that would enjoy this newsletter?

Share it with them and get access to The PLGeek Growth Process. This is a refined version of the growth process I ran that fuelled growth at Snyk and countless companies I’ve advised.

{{rp_personalized_text}}

Or just share this link with them: {{rp_refer_url}}

💪 POWER UP

If you enjoyed this post, consider upgrading to a VIG Membership to get the full Product-Led Geek experience and access to every post in the archive including all guides. 🧠

THAT’S A WRAP

Before you go, here are 2 ways I can help:

Book a free 1:1 consultation call with me - I keep a handful of slots open each week for founders and product growth leaders to explore working together and get some free advice along the way. Book a call.

Sponsor this newsletter - Reach over 7600 founders, leaders and operators working in product and growth at some of the world’s best tech companies including Paypal, Adobe, Canva, Miro, Amplitude, Google, Meta, Tailscale, Twilio and Salesforce.

That’s all for today,

If there are any product, growth or leadership topics that you’d like me to write about, just hit reply to this email or leave a comment and let me know!

Until next time!

— Ben

Rate this post (one click)

PS: Thanks again to our sponsor: Dovetail